Technical view by Nooresh |

| Bank Nifty is up 13% from the lows and 5% away from previous tops Posted: 19 Apr 2013 04:00 AM PDT

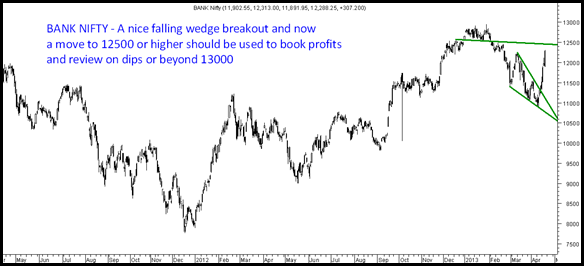

In the last 7 sessions Bank Nifty has bounced 13% from the lows of 10888 to around 12300. This is a bounce of 13% from the lows. At the current price it is only 5% away from the highs of January.

This is in midst of solid negative reports and views. Expose by Cobrapost which helped us take a superb intra day trade – See this post . We are back above the levels of that day. First Global – Shankar Sharma outfit came out with this ultra negative report –

Recently had posted a detailed blog post on April 9 – Be Fearful When Others Are Greedy and Greedy When Others Are Fearful – Nifty/Sensex Technical View

Also in that had posted this detailed report discussing Nifty, Bank Nifty and Global Indices which was for institutional clients.

Special Report – Equities – Get Ready for a Bright Future Special Report – Equities – Get Ready for a Bright Future Hope this report works out like the last one in August – Forget the Past when we turned extremely bullish at 5200 – Forget the Past – http://www.nooreshtech.co.in/2012/08/analyse-india-forget-the-past.html

( There was some error in the posting so one could not access the special report which has been rectified )

Even Nifty has bounced 300 points or roughly 5.5-6% from the lows even after a big drop of Infy ( its 8-9% of the index weight )

The bounce has been too quick and too fast and even we at Analyse India could not capitalize the total 13% but did get a few trades on Yes Bank, HDFC Bank and long shorts on Nifty. The view now is to book profits in our favored banks ICICI /Axis and Bank Nifty at 12500 and review on dips or if it crosses highs of 13k.

Expect the action to shift to broader markets by June. Will post Nifty views and stock charts later.

Nooresh Merani

Related posts:

|

| Periodic Call Auctions For Illiquid Stocks – SEBI – Anti Investor Posted: 19 Apr 2013 12:41 AM PDT For the last few weeks was wanting to write an article on the new periodic call auction brought up by SEBI which i believe is totally anti investor and not properly thought or implemented.

But there are a few articles written which would be explain it better.

This one by Bosco – http://zeenut.blogspot.in/2013/04/periodic-call-auctions-for-illiquid.html

SEBI has recently introduced a "Periodic Call Auction" for illiquid stocks in India. Readers are invited to read about the modalities of the new system in the SEBI circular available here : http ://ww.sebi.gov.in/cms/sebi_data/attachdocs/1360851620748.pdf List of stocks termed as "illiquid" as per the SEBI formula and therefore covered under the new system, was released by the Bombay Stock Exchange (BSE) on 1st April 2013, and can be seen here : http://www.bseindia.com/markets/MarketInfo/DispNewNoticesCirculars.aspx?page=20130401-39 There are 2050 stocks in the above list , which constitutes more than half of the active & listed stocks on the BSE. There are 1.32 crore folio holders in these "illiquid" stocks, as per an Economic Times article published on 16th April, 2013. While the intentions of the move to introduce the new system for trading in these "illiquid" stocks are not explained in the SEBI circular, they are believed to be laudable (to curb manipulation, reduce price volatility & impact cost, enhance liquidity). The circular itself simply states that the recommendation was made by the Secondary Market Advisory Committee (SMAC) . However, to many investors including the author of this note,the cure seems worse than the disease. This writer would summarize the concerns thus : 1. Practical Difficulties Of The New System – Harasses both the office goer, and the broker In the new scenario, once investors get familiar with the nuances of the new system, most activity will get concentrated towards the end of the first 45 minutes(reserved for order entry / modification / cancellation) of the hourly call auction session. This is because orders can be entered, changed or cancelled till the very end of this 45 minute session, which can result in the shifting of the "equilibrium price" at which the orders will be struck. So the last few minutes of this part of the session, i.e. the business end, is when investors will need to be trading online, or else in contact with their brokers, to be able to react to changes in what other participants are doing, to give their order the best chance to be executed. Unlike in the normal system, wherein the investor can take an appropriate decision & execute his order instantaneously. So an investor will have effectively few minutes in every call auction session , for 6 hourly sessions, to try to ensure a successful trade in the so-called illiquid stocks. Pending orders at the end of each hourly session will be purged, and so orders need to be re-entered in each subsequent session if required. If an office-goer wants to place an order, it will be very difficult for him to log in multiple times a day during office hours to feed in the same order again & again, if it remains unexecuted. It may also be difficult for him to log-in towards the end of the 1st 45-miute period of each hourly session, to give himself the best chance of executing his order. Else, if he opts to trade through a broker, the small brokerage on his orders may not justify the broker to take the trouble of re-entering his order every session, and he might be politely declined, or he may be charged a higher brokerage , or told to give his broker a free hand on prices. Even if the investor wants to take a call himself on what to do, will he be able to get through to his broker at the crucial time, given that many fellow investors will also be doing the same , is the question. And finally, day traders who provide much needed liquidity will find it unfeasible to trade in this new system (more on this later). This will surely lead to lower depth in the market. Net result, both the investor’s right to trade, and his right to get the best possible price will be hampered. Similarly, for the Broker too it will be a herculean job to :

Whether the new mechanism will curb manipulation is questionable, but that it will make life difficult for millions of small investors is unquestionable (by making it very difficult for them to execute orders in more than half of the listed & active stocks) ! World over exchanges & regulators look for means to improve liquidity, here we have just done our best to limit trades & curb liquidity ! Instead of encouraging the equity cult in India, it appears we wish to stamp it out ! 2. Majority of active & listed stock market companies in this list, so severe wealth erosion could be in store for investors, who could find exit difficult This writer apprehends that the new system will lead to investors & institutions shunning these so-called "illiquid" stocks, reducing liquidity further, and thus severely hampering any exit for existing shareholders. According to an Economic Times report on 9th April, 2013, around Rs 80,000 – 1,00,000 crore worth of investor wealth is blocked in companies shunted out of active trading & into the new mechanism.While Rs 1 lakh crore may be a small percentage of the total market capitalisation of listed companies, it is by no means a small sum. In fact, the new rules, besides affecting shareholders of the so-called "illiquid" group very negatively, will also impact all other investors. Not only will the "illiquid" companies be shunned, other small/mid-caps may also be shunned as investors may fear that these shares to may one day end up in this "illiquid" list & be declined for continuous trading. Also, if an investor needs to take money out of the market and is unable to liquidate an "illiquid" stock because of the new rules, he may be forced to sell a "liquid" stock instead. Small caps, by their very nature are less liquid than larger caps, due to low equity base, and large promoter & related party shareholding. Most of the stocks declared "illiquid" have been displaying similar (low) trading volumes for last many years & investors have been buying & selling these shares, inspite of the lower liquidity & higher impact cost.Now suddenly, they face barriers to trade in these stocks. Erecting such barriers to trade is not the hallmark of a free market economy. To make matters worse, the criteria for "illiquidity" is arbitrary & illogical. As per this "one size fits all" criteria which requires 10000 shares to be traded daily to be termed liquid, a stock quoting at 50 Paise would require just Rs 5000/- worth of turnover daily to stay liquid, whereas a stock quoting at Rs 500/- would need trading value of Rs 50 lakh daily to remain liquid. It is also likely that several manipulated stocks may not make it to the "illiquid" list precisely because of manipulated volumes. So it does look like the criteria will actually affect less liquid stocks indiscriminately, overwhelming majority of which are not being manipulated. 4. Detrimental Impact On Small Companies Another consequence of this action could be the gradual elimination of small but genuine companies from our stock markets, as it will be difficult for them to raise funds via the equity route from investors/institutions for expansion or other purposes, if their stocks are subject to such trading curbs. These companies might thus be forced to go in for debt -which may not be available to them, or may be available on unfavorable terms (higher interest rates) . So a decision which is best left to the company may now be practically forced upon them. All this even as the Finance Minister actively encourages SME’s to list. 5. Favours a section of Promoters at the cost of shareholders One section that the author feels might actually benefit from this new scenario will be certain cash rich promoters who might see the opportunity to (a) raise stakes cheaply, or (b) delist their stocks cheaply in future. Lack of proper price discovery & lack of free exit to shareholders will make their job easy. Note that many companies with MNC pedigree have also found their way into this list, i.e. companies like Disa India, Vulcan Engineers, CMI FPE , De Nora India, Fullford (India) , Yuken India etc ! Yes, eventually Mutual Funds may also benefit from higher flows of the money earmarked for the equity (cash) market. But surely the way to entice investors to park their money with Mutual Funds should be via sterling performance of mutual funds, not be reducing other avenues for investment ? 6. Doesn’t quite encourage Long Term Investing, does it ? If investors like to buy & hold for long term, and not repeatedly churn their portfolio, or frequently trade, they may well be indirectly shooting themselves in the foot, because if many other shareholders in the same company also do the same (hold for Long Term without trading) they will contribute to sending the scrip into "illiquid" category , with resultant consequences !! 7. Promoting F&O trading at the cost of the Cash Market ?Day Traders eliminated from new segment. Last year SEBI allowed exchanges to introduce LSE’s (Liquidity Enhancement Schemes) to enhance liquidity of illiquid securities in their equity derivatives segment. It recently allowed a similar facility in cash markets. But the ink had hardly dried on that circular , when it introduced the new system for "illiquid" securities in it’s cash segment. 8. Motivation/Objectives for new system not communicated & basis of confidence in meeting these objectives unclear As the author mentioned at the outset, the reasons that motivated SEBI to introduce the new system for trading in "illiquid" scrips are not explained in the SEBI circular, however they are believed to be :

If the objective is to curb manipulation, as already stated, many manipulated stocks may not make it to the "illiquid" list (or be out of it in due course) precisely because of manipulated volumes. So it does look like the criteria will actually affect less liquid stocks indiscriminately, overwhelming majority of which are not being manipulated. So basically the retail investor would be facing the music for the inability or unwillingness of the stock exchanges(with their expensive surveillance systems) to curb the activities of the manipulators . If the reasons are to reduce price volatility & impact cost, this would be dependent on the new system ensuring greater participation & enhancing liquidity in these "illiquid" scrips vis-a-vis the earlier continuous trading. Since day traders are more or less eliminated in this segment, the author finds it difficult to convince himself of this outcome. No statistics / studies have been shared with the public to give investors more confidence in this outcome. In fact, initial data post the implementation of the new system suggests quite the opposite outcome, though it is early days yet. In fact, the author believes that such a periodic call auction system for illiquid scrips has never replaced continuous trading without the simultaneous provision for liquidity enhancers (market makers). Maybe we are closing in on the actual motive ? Just kidding. 9. BSE most affected The BSE is the exchange most affected by this change, as it has the maximum listed stocks. More than 50% of active & listed stocks on the BSE have been put under the new mechanism. The result is a marked fall in turnover on the BSE since the introduction of the new system. This does seem to be unfair on the BSE, and thus puts it at a disadvantage vis-a-vis it’s competitors. The author finds it strange that the BSE has taken this lying down. Maybe the BSE sees small investors as a nuisance. Or maybe since it adopts a comatose attitude to manipulators, it feels it cannot apply double standards and act with alacrity in this case. 10. No Public Comment sought on a matter that affects millions of investors. Investor interests not protected in the current system ? It was only fair that the new rules & the criteria for judging "illiquidity" should have been put up for public comment before a decision was taken, given that millions of investors are impacted by the same. This was not done. It would be pertinent to note that that in the 16 member SMAC which advises SEBI on secondary market issues, and which made the recommendation of this new system, Investors / Investor Associations have only a single member representation , i.e. only a 6.25 % weightage on the SMAC committee. So is it any wonder that millions of investors have been shortchanged ? 11. No system to check that brokerages / securities firms are geared up for the new changes The author has an online trading account with one of the largest brokerages in the country – HDFC Securities Ltd. On D-Day 8th April, 2013, and without any notice, the author found that he could no longer trade online in the stocks moved to the "Periodic Call Auction". It appears that HDFC Securities would not allow it’s clients to trade online in the new category. Exact reasons were not intimated, but clients were told they would have to use Call-N-Trade instead. The author explained that Call-N-Trade was not at all suitable for "Periodic Call Auction" system, where the equilibrium price needs to be continuously monitored, especially towards the end of the Order Entry period of each session. But to no avail. As of the date of writing this, i.e. 16th April, 2013, the firm has not communicated any willingness (or date) to allow the same. * The author believes that many investors are sailing in the same boat. So a section of the market, not insignificant in number, has been effectively eliminated . Surely the wrong way to go about implementing a new system ? * 18.4.2013 -> Subsequent to posting this article, the author has been informed by HDFC Securities that they would be providing online trading facility in these scrips (though no commitment on expected start date). ++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++ The author’s humble alternate suggestions are as follows : 1. If the intention of the new rules are to check manipulation, then SEBI should make the new rules applicable to genuinely dubiousstocks, regardless of liquidity or illiquidity – not stocks that simply happen to be sparingly traded. 2. If this cannot be done, at least modify it to make it workable . Some suggestions : a. Have a call auction session once in the morning & evening, with a continuous trading session in between. b. Remove the restrictive clauses – like unfair penalties, no hidden orders etc c. Change the quantitative criteria drastically – so that truly illiquid stocks are separated from less liquid stocks 3. Ideally, the new system should be temporarily suspended, public input should be sought, and a proper evaluation undertaken of the inputs received , before re-introducing the same in a workable format ++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++ Author : Bosco Menezes Date : 16.04.2013

Another article by Neeraj Marathe also details a bit – http://neerajmarathe.blogspot.in/2013/04/sebis-new-baby-rules-for-illiquid-stocks.html

Another article by moneylife – http://www.moneylife.in/article/curbing-manipulation-in-illiquid-stocks-another-harebrained-idea-by-sebi/31833.html

SEBI should better work on finding manipulated stocks like some mentioned here – http://fraudex-2011.blogspot.in/2011/04/e-109-crystal-plaza-new-link-road.html

There are many such manipulations which has been mentioned on the blog but no action taken. posts – Farmax Retail, ThinkSoft, texmo Pipes , Syncom Healthcare , SEBI busts stock manipulating network

Hope that better sense prevails and some solution comes in for above issue.

Best Regards,

Nooresh Related posts:

|

| You are subscribed to email updates from Technical view by Nooresh To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment