Technical view by Nooresh |

- Cipla – Defensive Investment pick for 1 year

- Nifty moves 150 points in a day !!

- India Vix at 18 and Nifty 6130 – Will it be a deadly combination ?

| Cipla – Defensive Investment pick for 1 year Posted: 15 May 2013 11:17 AM PDT

Quick Technical View:

-> Technically Cipla is testing the 5-6 year trendline which we expect would breakout on the upside in the future.

-> At current levels of 410 the short term breakout is at 415-420 above which can see a quick spurt to 450. ( this is the short term idea generated today )

-> Given its a pharma stock comes into low beta gives us a good risk-reward opportunity. Fundamentally things are changing as per a quick analysis.

-> Personal expectation is in the next 1-2 years the stock can go the Hindustan Unilever way ( Had been recommending from 270-330 ) . Can surprise beyond the targets mentioned.

-> A must in a large cap portfolio for long term.

Disclosure: Invested with a long term view and trading regularly only on the long side

Nooresh Merani www.analyseindia.com ( For all our services ) Twitter – https://twitter.com/nooreshtech Facebook – https://www.facebook.com/nooreshtech Related posts:

|

| Nifty moves 150 points in a day !! Posted: 15 May 2013 11:10 AM PDT In the last few days though have not posted much on Nifty but had been tweeting about the risk of Vix and Nifty as a deadly combination ( see todays post – http://www.nooreshtech.co.in/2013/05/india-vix-at-18-and-nifty-6130-will-it-be-a-deadly-combination.html )

After a quick drop 2 days back Nifty has now crossed into new highs for the year and trapping the shorts. This is mainly the reason one needs to stick to the trend.

For us at Analyse India there are couple of interesting things which happened.

In our daily newsletter service we do send a daily Nifty view / Trade idea if any.

-> We initiated a buy at 5960-5980 spot levels for a target of 6050.

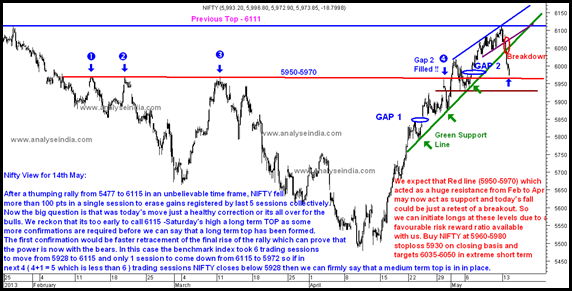

This is the detailed view and Nifty chart

Nifty View for 14th May: After a thumping rally from 5477 to 6115 in an unbelievable time frame, NIFTY fell more than 100 pts in a single session to erase gains registered by last 5 sessions collectively.Now the big question is that was today’s move just a healthy correction or its all over for the bulls. We reckon that its too early to call 6115 -Saturday’s high a long term TOP as some more confirmations are required before we can say that a long term top has been formed.The first confirmation would be faster retracement of the final rise of the rally which can prove that the power is now with the bears. In this case the benchmark index took 6 trading sessions to move from 5928 to 6115 and only 1 session to come down from 6115 to 5972 so if in next 4 ( 4+1 = 5 which is less than 6 ) trading sessions NIFTY closes below 5928 then we can firmly say that a medium term top is in in place. We expect that Red line (5950-5970) which acted as a huge resistance from Feb to Apr may now act as support and today’s fall could be just a retest of a breakout. So we can initiate longs at these levels due to a favorable risk reward ratio available with us. Buy NIFTY at 5960-5980 stoploss 5930 on closing basis and targets 6035-6050 in extreme short term.

. The bad part is we booked profits at 50-70 points and we see the index moving another 100-120 points

Now comes the fortunate part.

-> We were short Bank Nifty and made around 150 odd points and covered at 12500-12550 levels and is now at 13000

-> We had a lot of stock longs initiated today and day before giving quick jumps

-> most importantly WE are NOT SHORT

This is how trading works – You cannot make full part of every move and sometimes totally miss out but if you can consistently trade low risk-reward opportunities the quarterly returns do look good.

Follow the trade plan , wait for the next opportunity and stay disciplined. Right now we have no trade on Nifty but we wont be hesitant to short/long in next few days if the technicals and risk-reward point to the same.

If you would like to opt for the Newsletter service which is sent only via e-mail – Do mail us on analyseindia@analyseindia.com

Best Regards,

Nooresh Merani www.analyseindia.com ( For all our services ) Twitter – https://twitter.com/nooreshtech Facebook – https://www.facebook.com/nooreshtech Related posts:

|

| India Vix at 18 and Nifty 6130 – Will it be a deadly combination ? Posted: 15 May 2013 01:40 AM PDT Over the last 2-3 sessions have been tweeting about the risk of VIX going up with the Index. This combination can at times lead to a sharp short covering move which is 6-10% on the Index. Derivative analysis tells

Just posting previous charts. The risk is of a big move in Nifty and Midcaps but just that we were heavily bullish at 5500-5600 ( read this report – Equities – Get ready for a bright future ) gives us a bias to go long on Nifty at 6100 so would prefer stock specific.

Dislcosure: No position on Nifty but we have picked up a lot of PSU banks and trading long in stocks for past few days and may do in the future.

The last rise in Sept 2012 when we had initiated a major buy report – Forget the Past.

The major rise in 2010 which was 800-900 points.

The most important part is in this period we see huge moves in midcaps.

One stock recommended today is Aegis Logistics which we expect a sharp jump. Even JP associates can be a big gainer.

We would soon be putting out our top PSU Banks list. For now have initiated a strong buy on BOB at 708

Nooresh Merani www.analyseindia.com ( For all our services ) Twitter – https://twitter.com/nooreshtech Facebook – https://www.facebook.com/nooreshtech Related posts:

|

| You are subscribed to email updates from Technical view by Nooresh To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment