Technical view by Nooresh |

- Technical Charts – Century Textiles, Crompton , MTNL , NMDC , Sintex

- MIDCAP /SMALL CAP INDICES – Time to catch up and stop under performing ?

- Karnataka Bank – Speculative buy above 153 for a target of 175

- Grasim – Watch for the 3000-3020 mark for a breakout

| Technical Charts – Century Textiles, Crompton , MTNL , NMDC , Sintex Posted: 06 May 2013 11:17 AM PDT

After the previous post on Karnataka Bank which has given a nice breakout and Grasim waiting for 3000. Some more charts which look interesting

Century Textiles – The downward trend line is broken on the upside indicating selling pressure is finally over. After a consolidation for the past few weeks can expect a bounce to 315-330

Crompton Greaves — A small bounce to 105 is possible. Review on closing above for a fresh trend change

MTNL – Another dead stock finally seems to be coming to life with large volumes today. This can even be a bet for the next 1 year if market men are to be believed with a possible upside to 40-50 ( Market rumours ). Technically 25 seems to be on cards.

NMDC – Can coming into the index make a difference to the stock? Falling wedge gives us a good risk reward with stoploss of 123. Short term bounce to 136 and beyond that could be a major trend change

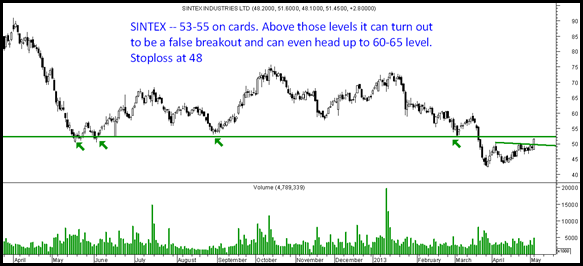

SINTEX — Another fallen hero finally seems to be turning around again. A quick bounce to 53-55. Beyond 55 we could even look at 65. Good risk reward. Stoploss at 48

Another small cap stock which we have picked up as a short term trade is Elecon Engineering.

Disclosure: Would have recommended some of the stocks today in the above and some might be on radar

TECHNICAL ANALYSIS WORKSHOP – FRESH SCHEDULE

MUMBAI – MAY 18-19FOR MORE DETAILS MAIL TO ANALYSEINDIA@ANALYSEINDIA.COM OR CALL NOORESH 09819225396 ANKIT 09899899989

Best Regards,

Nooresh Merani

www.analyseindia.com ( For all our services )

Twitter – https://twitter.com/nooreshtech

Facebook – https://www.facebook.com/nooreshtech Related posts:

|

| MIDCAP /SMALL CAP INDICES – Time to catch up and stop under performing ? Posted: 06 May 2013 11:01 AM PDT After the good move in Nifty of 10% on expected lines – Check Link we have been mentioning that one should now focus on broader markets.

Expect next 3-4 months could see some serious performance by midcaps/smallcaps. Bounce backs of 15-30% in many stocks may come in a jiffy. Next couple of weeks could be a good time to go shopping.

smallcap indices are close to Nifty equivalent levels of 4800-5000 and levels of june 2012 whereas Midcap index could be a little higher but they are still faraway from the tops equivalent of 6100 Nifty.

Will post some more stocks which can be looking good for bounce backs in the midcap/smallcap segment in the next post.

TECHNICAL ANALYSIS WORKSHOP – FRESH SCHEDULE

MUMBAI – MAY 18-19FOR MORE DETAILS MAIL TO ANALYSEINDIA@ANALYSEINDIA.COM OR CALL NOORESH 09819225396 ANKIT 09899899989Related posts:

|

| Karnataka Bank – Speculative buy above 153 for a target of 175 Posted: 06 May 2013 01:56 AM PDT

The stock has given a falling trendline breakout some time back.

over the past few days keeps getting resistance around 153. Sustaining above 153 can see a move to 165-175 in a fast manner.

An alternate trade would be to short kotak and buy ktk.

Please do your risk management as its a momentum trade on breakout only

TECHNICAL ANALYSIS WORKSHOP – FRESH SCHEDULE

MUMBAI – MAY 18-19FOR MORE DETAILS MAIL TO ANALYSEINDIA@ANALYSEINDIA.COM OR CALL NOORESH 09819225396 ANKIT 09899899989Related posts:

|

| Grasim – Watch for the 3000-3020 mark for a breakout Posted: 06 May 2013 12:16 AM PDT

Grasim ————- Watching for a breakout above the 3000-3020 mark.

TECHNICAL ANALYSIS WORKSHOP – Fresh schedule

MUMBAI – MAY 18-19For more details mail to analyseindia@analyseindia.com or call Nooresh 09819225396 Ankit 09899899989Related posts:

|

| You are subscribed to email updates from Technical view by Nooresh To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment